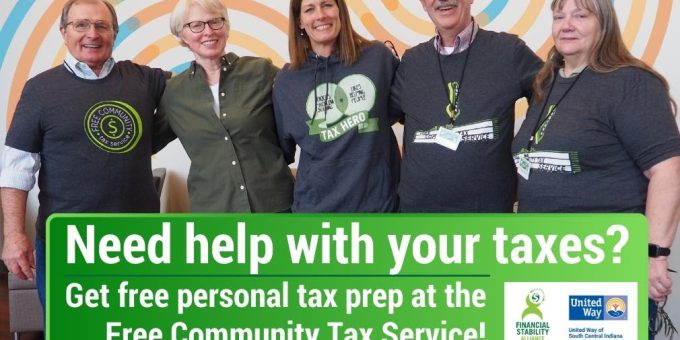

INDIANA – Tax season is nearly here. United Way of South Central Indiana and community partners will host free in-person and online tax preparation for its 2024 Free Community Tax Service.

In-Person Service

Starting Monday, January 29th, IRS-certified volunteers will serve clients at nine in-person sites in Brown, Monroe, and Owen counties (including a Spanish Language site). Hoosiers making less than $60,000 annually can receive free help filing their federal and Indiana state tax returns. Sites are currently accepting appointments.

Lawrence County and the surrounding area residents are welcome to use the service sites in Owen, Monroe, and Brown counties.

Tax preparation is provided free of charge and volunteers work one-on-one with community members to ensure they receive 100% of their refund, including the Earned Income Tax Credit (EITC), if eligible.

Online Service

Additionally, area residents with a combined Adjusted Gross Income (AGI) of $79,000 or less can file online for free from the comfort of their homes or anywhere with an internet connection.

Visit www.unitedwaysci.org/FreeTaxes for information regarding both in-person and online tax preparation options.

Catherine Blankensop, Annual Giving & Community Impact Manager at United Way of South Central Indiana, says, “Now more than ever, the free tax service is needed to help strengthen the financial stability of people in our region. In addition to the money saved on preparation fees, these refunds and credits are critical to our clients and in bringing back money to be spent supporting our local economy. United Way of South Central Indiana is pleased to continue offering this valuable service to our community in partnership with our many dedicated volunteers who help residents file their taxes for free. We are grateful that our clients trust us with their tax returns.”

Bilingual Tax Preparation Assistance

The Free Community Tax Service team is partnering with the City of Bloomington to provide a full-service Spanish Language tax site. Spanish-speaking residents can file their taxes at this site with a certified bilingual volunteer, making the filing process much smoother and less intimidating for residents. Appointments can be made in Spanish by calling (812) 349-3860.

Nonresident Taxpayers

This year, no locations are certified to assist with preparation for nonresident taxpayers. Taxpayers who know the number of days they were present in the United States in 2021, 2022, and 2023 can calculate their residency status for tax purposes at www.unitedwaysci.org/freetaxes-residency. Nonresidents with any relation to Indiana University can contact the Office of International Services for assistance: www.ois.iu.edu.

Community Partners

Along with United Way of South Central Indiana and the Financial Stability Alliance, partners of the Free Community Tax Service include 211, AARP, Area 10 Agency on Aging Endwright Center East, Brown County Public Library, City of Bloomington, First Financial Bank, Indiana University Maurer School of Law, Ivy Tech Community College-Bloomington, MCCSC Broadview Adult Learning, Monroe County Public Library, Owen County Public Library, Regions Bank, and community volunteers.

Last year, the Free Community Tax Service helped residents file 865 federal returns, saving clients as much as $395,305 in tax prep fees and bringing back more than $980,004 in refunds and credits. United Way managed seven full-service tax sites, and AARP managed two sites. Working families received $209,308 in child tax credits. The Free Community Tax Service helps many seniors, who make up approximately 67% of the clientele.