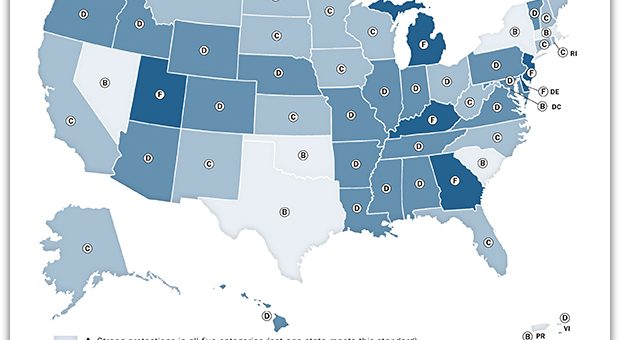

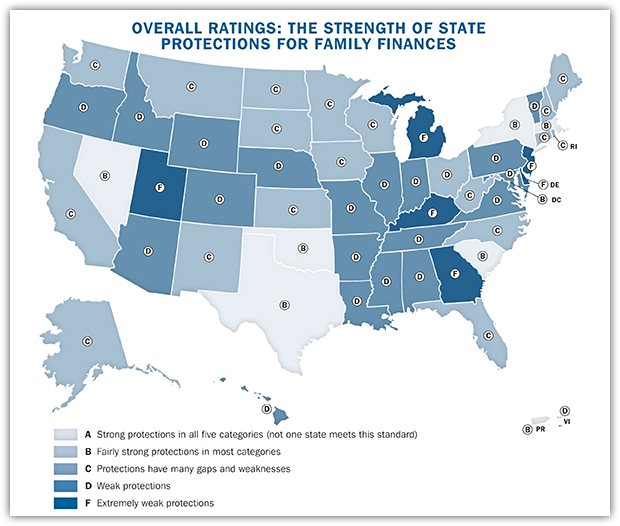

(UNDATED) – A new report from the National Consumer Law Center (NCLC) surveys the exemption laws of the 50 states, the District of Columbia, Puerto Rico, and the Virgin Islands that protect wages, assets in a bank account, and property from seizure by creditors.

No Fresh Start in 2019: How States Still Let Debt Collectors Push Families into Poverty finds that Indiana’s laws do not meet basic standards so that debtors can continue to work productively to support themselves and their families.

State grades are determined based upon the state’s protection of:

- a living wage

- the family home

- the family car

- a basic amount in a family bank account

- household goods

The report outlines key recommendations about reforms necessary for state property-exemption laws.

Learn more

- Download the full NCLC report.

- Read the Indiana Institute for Working Families’ policy brief on debt collection, which revealed that nearly one in three Hoosier borrowers has a debt in collections, and an estimated one in 10 has wages garnished.