INDIANA — As tax season kicks into gear, United Way of South Central Indiana is stepping in to ensure that local residents don’t have to choose between professional tax help and paying their bills. The organization’s Free Community Tax Service (FCTS) is now officially open, providing expert tax preparation at no cost to residents in Brown, Monroe, and Owen counties.

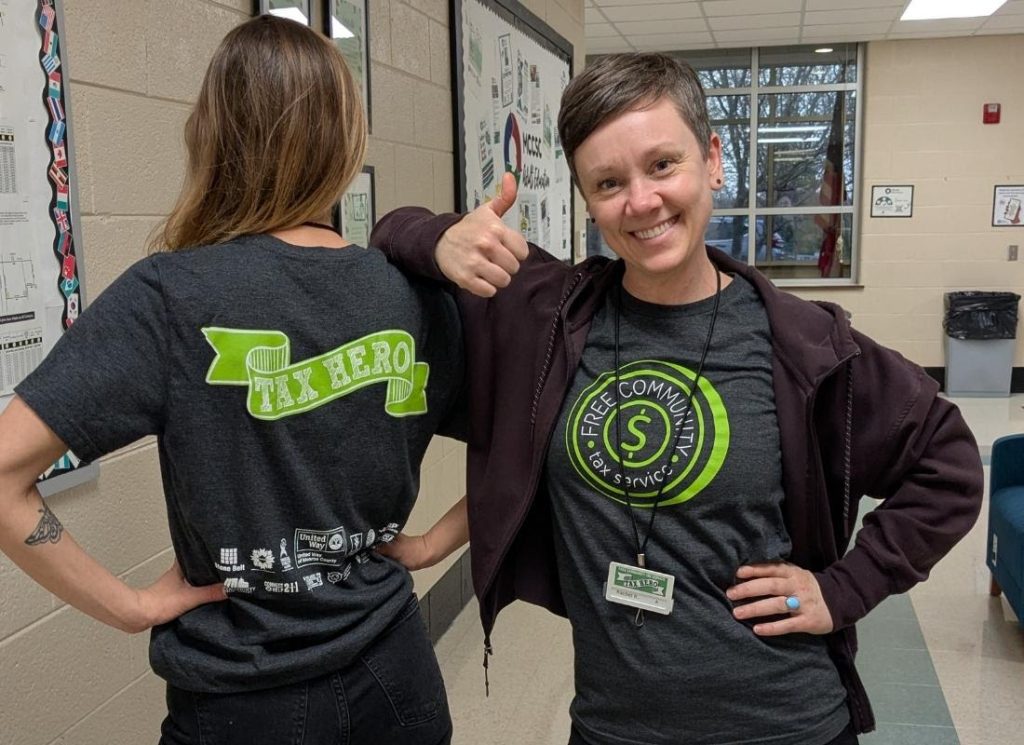

Starting this week, IRS-certified volunteers are staffing eight in-person sites across the region. For those who prefer to file from the comfort of home, the program also offers secure online filing options.

The program is designed to support low-to-moderate-income households who often face high fees from commercial tax preparers. By utilizing the FCTS, residents can keep 100% of their refund, including critical boosts like the Earned Income Tax Credit (EITC).

“Tax season doesn’t have to be stressful—or expensive,” the organization stated, emphasizing that their volunteers work one-on-one with clients to ensure every eligible deduction and credit is claimed.

Eligibility Guidelines

To serve as many neighbors as possible, United Way has established the following eligibility tiers:

| Service Type | Eligibility Requirement |

| In-Person Preparation | Individuals and families earning $67,000 or less. |

| Online Filing | Households with a combined AGI of $89,000 or less. |

| AARP-Managed Site | No income or age requirements (Located at Endwright East, College Mall). |

Where to Find Help

With eight locations now active, residents can find a site close to home. These sites are staffed by volunteers who have undergone rigorous IRS certification to handle a variety of tax situations accurately and securely.

Beyond the financial savings, the program aims to provide peace of mind. By providing “trusted tax preparation,” United Way hopes to reduce the seasonal anxiety that many residents feel regarding government filings.