INDIANA – Governor Mike Braun announced today that Indiana is opting into a new initiative, which will allow Hoosiers to collect federal tax savings for investments made in K-12 scholarships. The new federal tax credit, established under President Trump’s One Big Beautiful Bill, applies to charitable contributions made to Scholarship Granting Organizations (SGOs) that serve eligible K-12 students.

“Parents are in charge of their children’s education,” said Gov. Braun. “As a state, we are prioritizing that through universal school choice and a state tax credit for donations made to scholarship granting organizations, which helps make a high-quality education accessible and affordable for every Hoosier family. Under President Trump’s leadership, we welcome this increased focus on school choice at the federal level and are ready to leverage this additional, federal tax credit to expand opportunities for students and families across our state.”

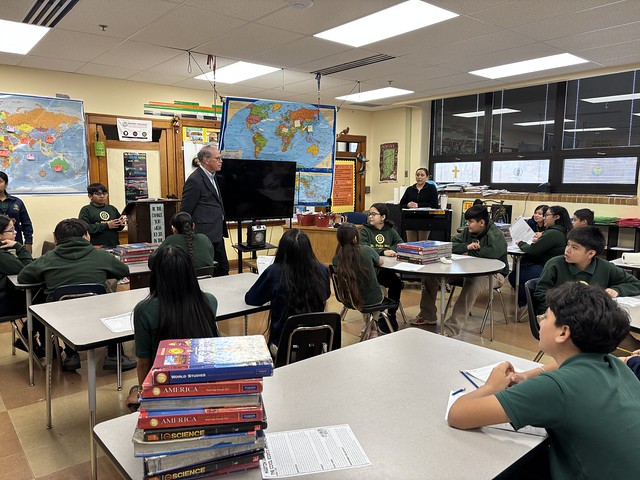

Governor Braun visited Saint Philip Neri Catholic School to mark the occasion of opting into the new federal tax credit that will help parents remain in the drivers seat of their children’s education. Gov. Braun spoke with teachers, and students showed him some of their most recent projects.

Families can access scholarships through eligible SGOs to support qualified educational expenses, including costs incurred for children at public and private schools, such as tuition, fees, tutoring, educational therapies, transportation, technology, etc.

Beginning January 1, 2027, individuals will be eligible for a nonrefundable federal tax credit of up to $1,700 for contributions to participating SGOs. Any unused credit may be carried forward for up to five years. The below Indiana-based SGOs have already indicated they plan to participate in the new federal tax credit program in 2027; others may continue to be added,

- Institute for Quality Education, Inc.

- Sagamore Institute Scholarship for Education Choice

- The Lutheran Scholarship Granting Organization of Indiana, Inc.

- School Scholarship Granting Organization of Northeast Indiana, Inc.

- Legacy Foundation

“Every child is unique, and Indiana is home to a variety of high-quality educational options to meet those needs, regardless of a family’s income or ZIP code,” said Dr. Katie Jenner, Indiana Secretary of Education. “This new federal tax credit will continue to drive investments in scholarships, ensuring high-quality educational opportunities are within reach for every learner, in an environment that helps them reach their greatest potential.”

The State of Indiana also offers a 50% tax credit for donors to qualified Indiana SGOs. There are no limits to the amount a donor can contribute to a qualified Indiana SGO.