INDIANA – If you are one of many Hoosiers that make estimated tax payments throughout the year, keep an eye on the calendar – the next due date is Thursday, Sept. 15.

It’s important to know how to successfully make your payment so you are not subjected to penalties.

What are estimated tax payments?

The Indiana income tax system is a “pay-as-you-go” system with many taxpayers withholding taxes from their income throughout the year. However, some taxpayers choose to make estimated tax payments to reduce the amount due when filing an income tax return.

Who owes estimated tax payments?

Generally, if you owe $1,000 or more in state and county tax for the year that isn’t covered by withholding taxes, you need to make estimated tax payments throughout the year.

When are estimated tax payments due?

Estimated tax installment payments are due on:

- April 15

- June 15

- Sept. 15

- Jan. 15 of the following year

If the due date falls on a weekend or a national or state holiday, then payment should be postmarked or scheduled online no later than the end of the next business day.

How to pay estimated tax payments

There are a few ways you can make an estimated tax payment. You can:

- Use the DOR-issued, preprinted estimated tax voucher provided to taxpayers with a history of paying estimated tax;

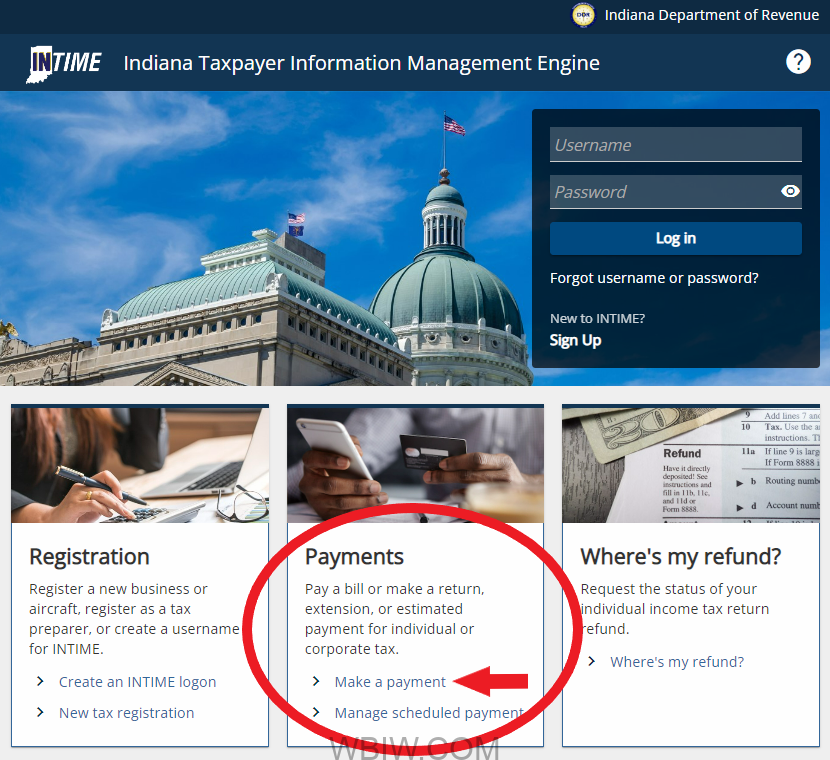

- Pay online via INTIME; or

- Complete Form ES-40 and mail it with your payment.

Of these options, the most efficient and safest way to pay online is via INTIME. You can choose to make your payment without logging in. Either way, you’ll receive a confirmation number at the end of your transaction for reference. That means no waiting for mail to arrive or checks to clear, and no penalties because you won’t miss your payment deadline.

You can also schedule future estimated payments via INTIME, login required.

DOR advises customers not to use a third-party service, such as a bill pay, through their bank because you cannot insert the appropriate payment voucher along with the check. Oftentimes, there is not enough information generated on the automated check to match the payment to the customer, which can cause delays and penalties for late payments.

How to make an online estimated payment without logging in

- Access INTIME at intime.dor.in.gov.

- Locate the “Payments” panel and click on the “Make a Payment” hyperlink.

- Go to the “Non-bill payments” panel and select the option to pay via bank payment (no fee) or via credit card (fee), then follow the prompts to enter information.

How to make a logged-in estimated payment via INTIME

- Access INTIME at intime.dor.in.gov.

- If you already have an INTIME username and password, log in to your account.

If you do not yet have a username and password, in the top right corner of the page, click on “New to INTIME? Sign up.” and follow the prompts.

- Once logged in, go to the “Summary” (tab) page and locate the “Make a payment” hyperlink in the “Account” panel.

- The option to make an estimated payment will appear in the “Payment type” drop-down.

- The filing period due date should say 31-Dec-2022 (the end of this tax year).

Refer to the INTIME User Guide for Individual Income Tax Customers for more information.

Accepted forms of payment via INTIME include bank payment (ACH/e-check), as well as Visa, MasterCard, and Discover debit or credit cards. Processing fee(s) will be assessed for debit or credit card payments. There is no fee for bank (ACH/e-check) payments.

You can learn more about paying estimated payments through INTIME by visiting dor.in.gov.