INDIANAPOLIS – A high-cost predatory loan is only made worse when the loan is larger and longer. But while residents in some states are gaining protections from these larger, longer-term products, Hoosiers are now paying more than before the COVID-19 crisis, according to a new report from the National Consumer Law Center. This report builds on NCLC’s extensive work on predatory lending.

“The Institute and Prosperity Indiana have been working to educate policymakers and the public about how harmful these high-cost loans are to financially vulnerable Hoosiers. This research will help us advance the 36 percent rate cap Hoosiers desperately need,” said Jessica Fraser, Director of the Indiana Institute for Working Families.

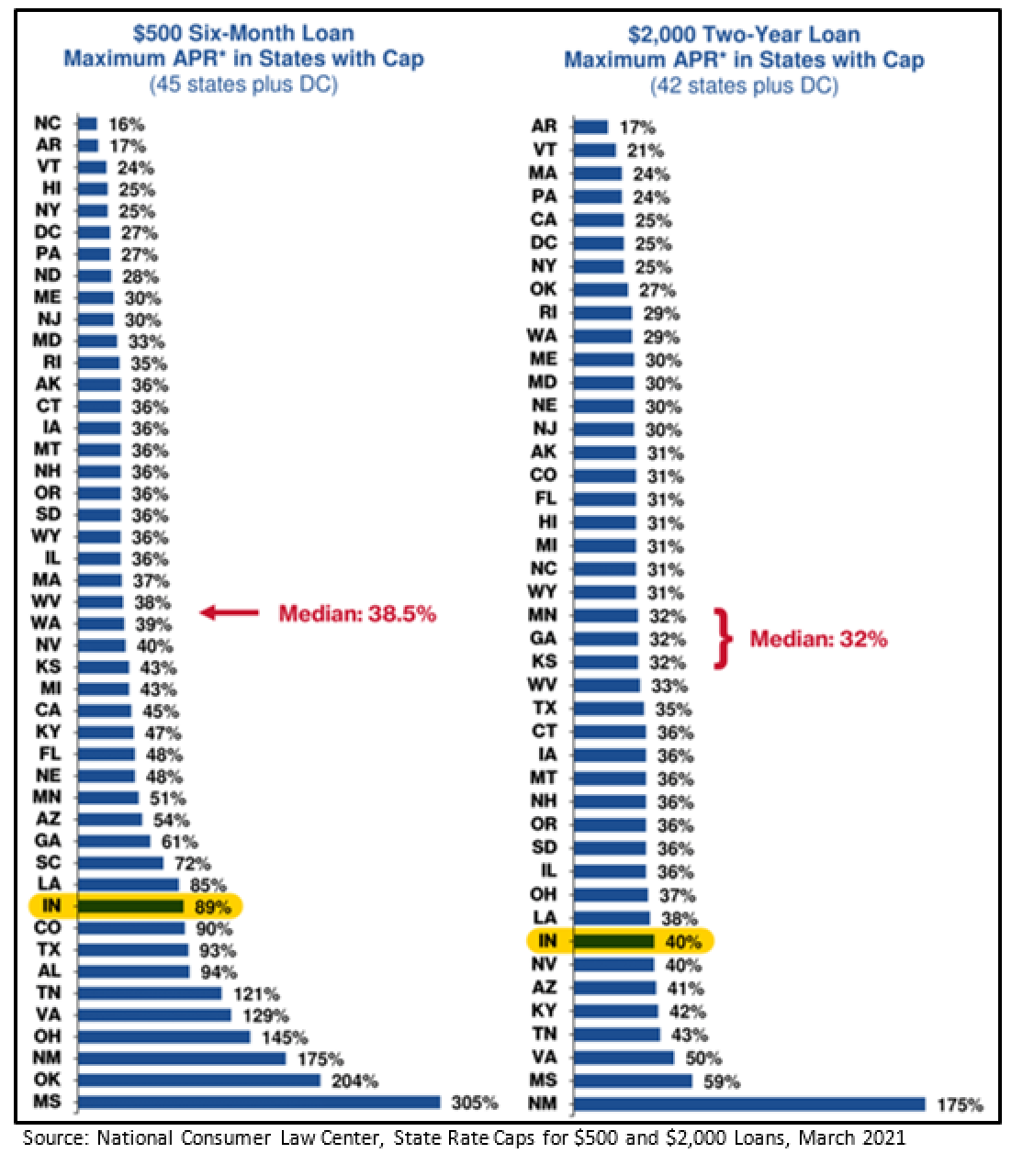

“This new report shows how Indiana stacks up against other states when it comes to rate caps, and it’s not pretty. Despite Hoosiers asking for more responsible lending policies, the state allows some of the highest rate caps in the Midwest. This is now pitting Hoosiers who are working to recover from the COVID-19 pandemic against the growing payday lending industry – a result of policies that have been moving in the wrong direction for years,” said Jessica Love, Executive Director of Prosperity Indiana.

In 2020, Indianaenacted a law (SEA 395) that increases the already excessive fees that lenders can charge and distorts the interest rate. The result is that non-bank lenders in the state can now charge an APR of 89 percent for a $500 six-month loan, an increase from 71 percent. For a two-year, $2,000 loan, the increased fee pushes the APR cap up from 39 percent to 40 percent.

“Since the pandemic, Indiana has failed to assist struggling families by decreasing rates on consumer loans and instead welcomed predatory lenders by increasing already excessive fees,” said National Consumer Law Center Deputy Director Carolyn Carter, author of the report. “To avoid trapping residents in long-term debt, we encourage a 36 percent interest rate, including all fees.”

Key Recommendations

- Cap APRs at 36 percent for smaller loans, such as those of $1,000 or less, with lower rates for larger loans.

- Prohibit loan fees or strictly limit them to prevent fees from being used to undermine the interest rate cap and acting as an incentive for loan flipping.

- Prevent loopholes for open-end credit. Rate caps on installment loans will be ineffective if lenders can evade them through open-end lines of credit with low-interest rates but high fees.

- Ban the sale of credit insurance and other add-on products, which primarily benefit the lender and increase the cost of credit, or require their cost to be included in the APR cap, as the Military Lending Act does for loans made to servicemembers.

- Examine consumer lending bills carefully. Predatory lenders often propose bills that obscure the true interest rate. For example, they may present a rate as being 24 percent per year plus 7/10ths of a percent per day, instead of acknowledging the rate as being 279 percent. Or the bill may list the per-month rate rather than the annual rate. To protect consumers, legislators should get a calculation of the full APR, including all interest, all fees, and all other charges, and reject the bill if it is over 36 percent.