INDIANA – new survey data on Americans’ habits and sentiments around bill pay and financial health, more than a year into the COVID-19 pandemic. This survey data is presented in doxoINSIGHTS’ new report, “Household Bills and Financial Health After a Year of COVID-19: Changes in Consumer Saving and Spending Habits.” The report shows where households saw the biggest change in their bills since March of last year, how these changes impacted their spending and saving habits, both in the short and long term, and whether a series of stimulus checks brought the expected financial relief.

Key findings from the report include:

95 percent of Americans said stimulus checks helped improve their financial health over the past year

- Over 9 in 10 people said the stimulus checks helped them between “a little” and “a great deal”

- 90 percent of people feel confident that stimulus payments will help the U.S. economy improve between “a little” and “a great deal”

- 63 percent of people believe their financial health will recover within a year, 74 percent of people believe the economy will take more than a year to recover

The majority of stimulus funds were used towards reducing household bills

- 3 in 5 Americans (60 percent) who received stimulus payments over the past year used them to pay household bills

- Of those, the most popular category to pay by far was Utilities, which was paid in 70 percent of cases

- The next most popular were Mobile Phone and Cable/Internet bills, which were paid in 41 percent and 39 percent of cases, respectively

- Paying down debt, at 17 percent, was the second most popular use while 10 percent of Americans put the money in savings

70 percent of consumers cut back spending in at least one household bill category due to the pandemic

- Nearly half (48 percent) of this group brought their cable & internet bill down

- 46 percent of those who reduced at least one bill cut back on expenses in the utility category

Residents of Bedford pay an average of $922 a month in 8 key household bill categories (, which is 9.3 percent lower than the national average of $1016.

Average Monthly Bill Costs

- Auto loan – $445

- Auto insurance – $178

- Utilities – $202

- Health insurance – $91

- Life insurance – $68

- Cable/Satellite – $115

- Mobile phone – $125

- Alarm security – $68

Average Monthly Bills for Others

- Bloomington -$852

- Seymour – $808

- Washington – $826

- Scottsburg – $852

- Columbus – $921

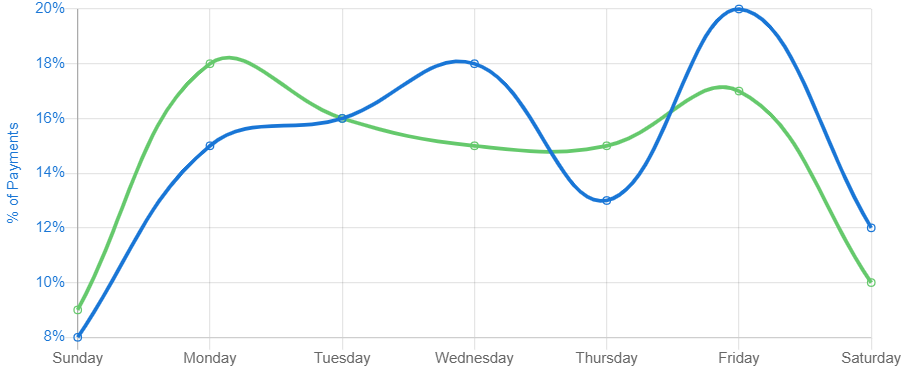

What Day of the Week Do People in Bedford Pay Their Bills?