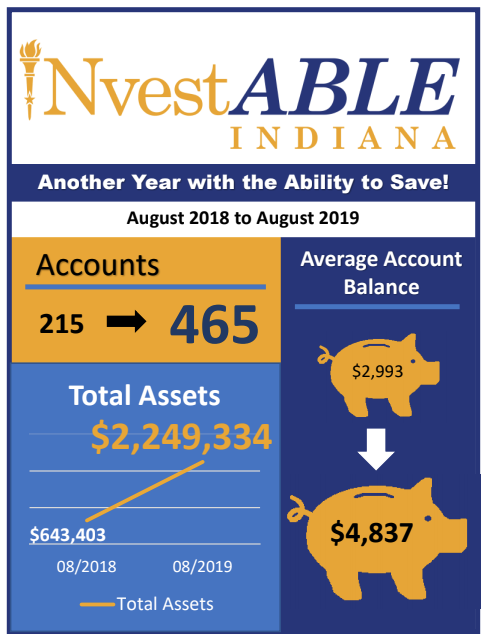

(INDIANAPOLIS) — Just over two years since the launch of INvestABLE Indiana, the program has seen substantial investment and utilization by Hoosiers living with disabilities. As of August 13th, the plan saw assets under management almost quadrupled from $643,403 to now more than $2,249,000 in the last year.

“ABLE plans are proving to be revolutionary for Hoosiers living with disabilities”, commented Indiana Treasurer of State Kelly Mitchell. “I am so glad more and more people are taking advantage of this life-changing tool.”

Not only has assets under management grown significantly but so has the number of accounts opened. Last year there were 215 open accounts. Currently, the plan has over 460 active accounts being used. This impressive growth is attributed to the work of the Indiana ABLE Authority and Indiana Treasurer of State Kelly Mitchell as they travel the state promoting the program to Hoosiers living with disabilities.

The Indiana ABLE Authority is constantly working to increase the reach of INvestABLEIndiana to make savings a reality for so many Hoosiers who previously could not easily save above $2,000. Now, the average ABLE account balance is over $4,800.

“INvestABLE allows those living with disabilities an opportunity to be more autonomous by saving money for future expenses not covered by benefits they may receive”, said Indiana ABLE Authority Executive Director Amy Corbin.

INvestABLE Indiana offers seven investment options, including a checking account option with a debit card. Up to $15,000 per year can be saved in an account, with a maximum account balance of $450,000. For an individual receiving Supplemental Security Income (SSI), they can save up to $100,000 in their INvestABLE Indiana account and not risk losing their monthly benefit. Money can be withdrawn and spent on qualified expenses or INvestABLE Indiana account holders can choose to grow their finances and create long-term savings with tax-free earnings. Contributions and earnings in INvestABLE Indiana accounts are not subject to federal or state income tax if spent on qualified expenses, similar to a 529 college savings account. Contributions are made with post-tax dollars.

More information about INvestABLE Indiana, including how to open an account, can be found here.